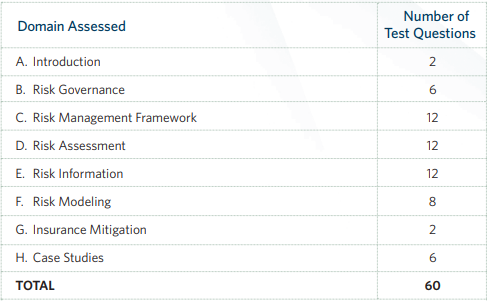

Operational Risk Manager (ORM) Exam 8010 actual questions are the best material for you to take the test. The ORM enrollment period is 12 months (365 days) and begins with the date that the certificate program fee is paid. The Operational Risk Management (ORM) syllabus addresses a comprehensive set of knowledge expected of an operational risk manager. The PRMIA ORM 8010 exam is to assess the current knowledge level of the ORM syllabus domain areas in relation to the global standard expected of an operational risk manager.

The ORM 8010 exam is computer-based, and questions are all multiple choice with four options, and one option is the correct answer. The ORM exam is offered in the English language only.

Operational Risk Manager (ORM) Exam 8010 actual questions are the best material for you to test the above PRIMA ORM 8010 exam domains. Share some PRIMA 8010 actual questions and answers below.

1.Economic capital under the Earnings Volatility approach is calculated as:

A. [Expected earningsless Earnings under the worst case scenario at a given confidence level]/Required rate of return for the firm

B. Expected earnings/Required rate of return for the firm

C. Expected earnings/Specific risk premium for the firm

D. Earnings under the worst case scenario at a given confidence level/Required rate of return for the firm

Answer: A

2.Which of the following carry greater counterparty risk: a forward contract on a 10 year note, or a commercial paper carrying a AA credit rating with identicalmaturity and notional?

A. The commercial paper has greater credit risk as the entire notional is outstanding

B. They both carry the same credit risk

C. Credit risk can not be compared in these terms

D. The forward contract has greater credit risk as its future gains are unknown

Answer: A

3.An assumption regarding the absence of ratings momentum is referred to as:

A. Time invariance

B. Ratings stability

C. Markov property

D. Herstatt risk

Answer: C

4.Which of the following statements is true:

A. Total expected losses are equal to the sum of individual underlying exposures while total unexpected losses are greater than the sum of unexpected losses on underlying exposures

B. Both total expected losses and total unexpected losses are less than the sum ofexpected and unexpected losses on underlying exposures respectively

C. Total expected losses are greater than the sum of individual underlying exposures while total unexpected losses are less than the sum of unexpected losses on underlying exposures

D. Total expected losses are equal to the sum of expected losses in the individual underlying exposures while total unexpected losses are less than the sum of unexpected losses on underlying exposures

Answer: D

5.As opposed to traditional accounting based measures, risk adjusted performance measures use which of the following approaches to measure performance:

A. Any or all of the above

B. adjust both return and the capital employed to account for the risk undertaken

C. adjust capital employed to reflect the risk undertaken

D. adjust returns based on the level of risk undertaken to earn that return

Answer: A